Is Your Plan at Risk of a Lawsuit?

- Lawsuits against retirement plan sponsors have skyrocketed. Excess fees, high cost options with low returns, and limited investment options are among reasons cited.

- These suits—even settlements and dismissals—occupy resources and distract focus from normal business operations.

A deliberate, thorough approach for retirement plan compliance will decrease the chances this happens to your organization.

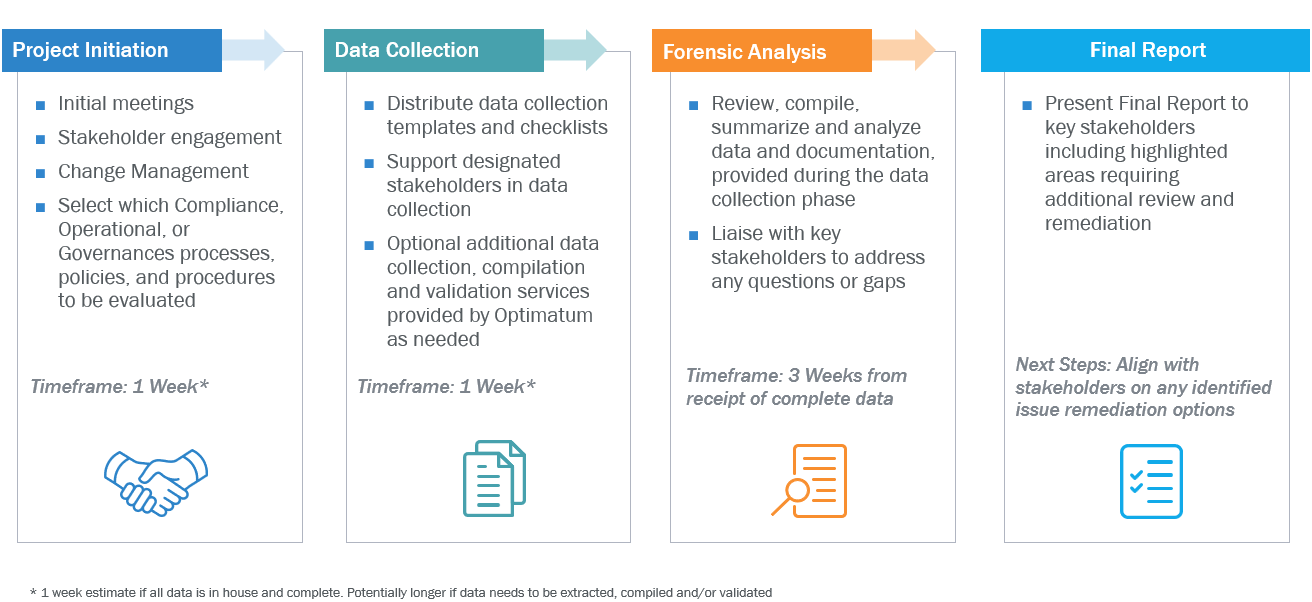

Optimatum’s Retirement Plan Checkup proactively supports your fiduciary responsibility, avoids financial penalties and audits, reduces the need for contribution recalculations and revisions, protects against lawsuits and bolsters employee relations efforts.

The three categories below encompass a wholistic review of a retirement plan’s structure, processes and vendors and delivers a comprehensive report including findings, risks, opportunities and potential next steps: