When addressing the now disbanded US healthcare initiative with Amazon, JP Morgan and Berkshire Hathaway, Warren Buffett noted that, despite the collaboration’s failure, Berkshire accomplished a “lesser objective”:

“We looked at 60 or 70 different operations we had presently… where a certain amount of centralization… can save real money. We found inefficiencies and some dumb things we were doing, so we got our money’s worth.”

Warren Buffett recognized the power of centralization to reap synergies across the Berkshire Hathaway portfolio. Although the methodology of centralization is often applied to various aspects of an organization, HR’s potential to create value through harmonization is often overlooked. Private equity sponsors, family offices and holding companies, such as Berkshire Hathaway, are in a unique position to leverage the aggregate purchasing power of their portfolio to capture value through HR harmonization thereby saving up to 10% of HR vendor spend.

This article illustrates the benefits, process, and results of HR harmonization.

Centralization, also referred to as consolidation or harmonization, has historically been utilized as a cost saving technique by the procurement department, typically applied to similar goods provided by several vendors. For example, engaging one vendor to provide printers, ink cartridges and paper can save time and money versus dealing with three separate vendors.

As the process of harmonization matures and evolves, companies are beginning to apply it to a wider variety of business aspects including:

- Vendor Harmonization: Increasing the volume of goods and “services” provided by a smaller group of best-in-class vendors;

- Process Harmonization: Streamlining processes to decrease inefficiencies;

- Policy Harmonization: Ensuring the same policies apply to similar situations to decrease confusion across the organization.

VALUE CAPTURE FOR PRIVATE EQUITY SPONSORS, HOLDING COMPANIES AND FAMILY OFFICES

HR Harmonization applies the general principles listed above to HR Operations. Although all companies can reap the benefits of reviewing, streamlining, and ensuring consistency in their HR operations, entities such as private equity sponsors, holding companies and family offices are prime candidates for capturing value through harmonization for several reasons. Firstly, these entities’ dynamic growth patterns through M&A activity often result in more disparate, unaligned programs and providers than other firms, and secondly, they can leverage the aggregate purchasing power of their existing portfolio to consolidate HR vendors across their holdings while concurrently streamlining policies, processes, and systems.

POTENTIAL AREAS OF HR HARMONIZATION

BENEFITS OF HR HARMONIZATION

Additionally, entities who engage in a harmonized HR vendor program can choose to retain complete autonomy of plan design and enjoy the benefits of program portability in the case of a divestiture.

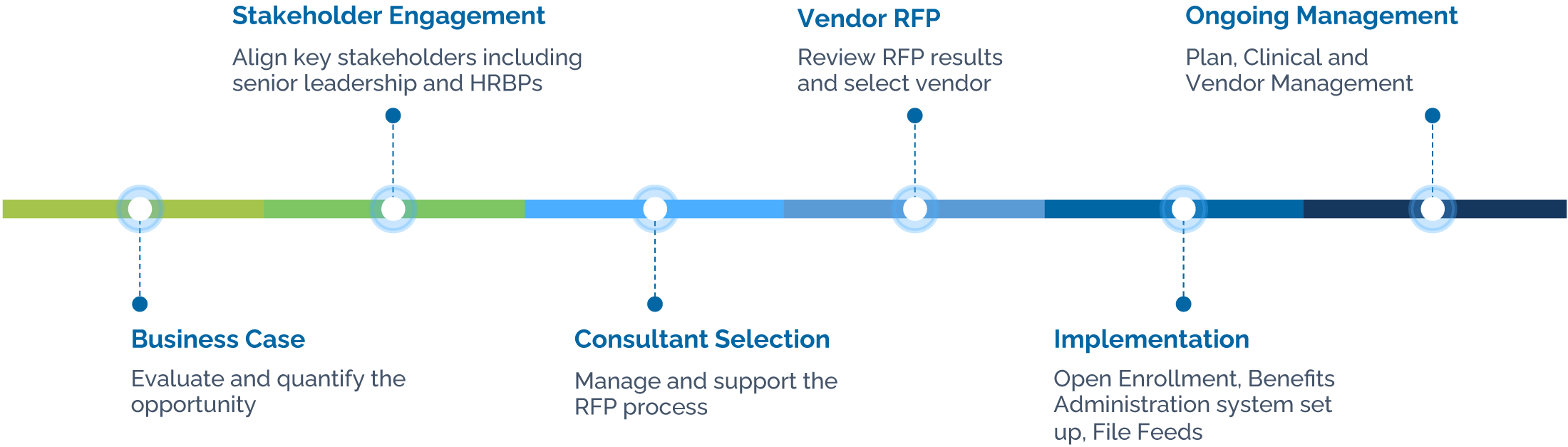

HARMONIZATION PROCESS AND TIMELINE

The harmonization timeline is dependent upon the specific area of focus. For example, the ideal timeline for Medical/Rx vendor harmonization is 6 months and should be initiated in the spring, for a go-live date of January 1st of the following year.

Below, is a high-level overview of the harmonization process:

Optimatum supports the HR workstream throughout the M&A lifecycle: from operational due diligence to day-one readiness and post-day-one synergies. Additionally, Optimatum helps sponsors leverage the aggregate purchasing power of their portfolio to capture value and drive margin expansion.

Creating value through HR harmonization is a proven strategy for saving up to 10% of vendor spend.

Optimatum assists sponsors in leveraging the aggregate purchasing power of their portfolio to capture value and drive margin expansion. We support and manage the entire process from pre-harmonization due diligence, implementation and Day One readiness, as well as post Day One vendor management to ensure on-going synergy capture.

Please contact us with any questions or for a free harmonization opportunity assessment.